Q2 2023 Industry Insights Report (IIR)

Consumer Credit Appetite Remains Strong Amidst Rising Interest Rates

Q2 2023 Report highlights include:

- Origination volumes increased across most credit products, despite the high interest rate environment, and were most notable for home loans and clothing accounts

- Credit card and vehicle loan delinquency rates improved, with consumers prioritising access to liquidity and private mobility

- Lenders seem more cautious in their risk appetite for traditional unsecured products, offering smaller average loan amounts and limits on new revolving products

The quarter saw yet another repo rate increase of 50 basis points by the South African Reserve Bank (SARB) in May, to 8.25%, with the prime lending rate rising to 11.75%, a 14-year high. However, June figures began to show signs of improvement in economic conditions, with the inflation rate falling to 5.4%, further supported by a drop of 0.3% to 32.6% in the unemployment rate, alleviating some financial strain in the market.

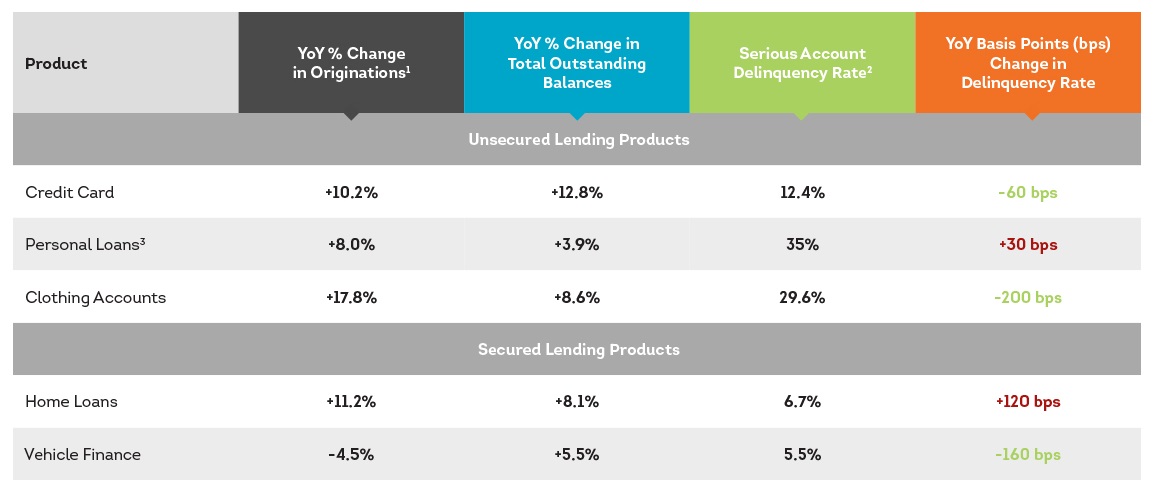

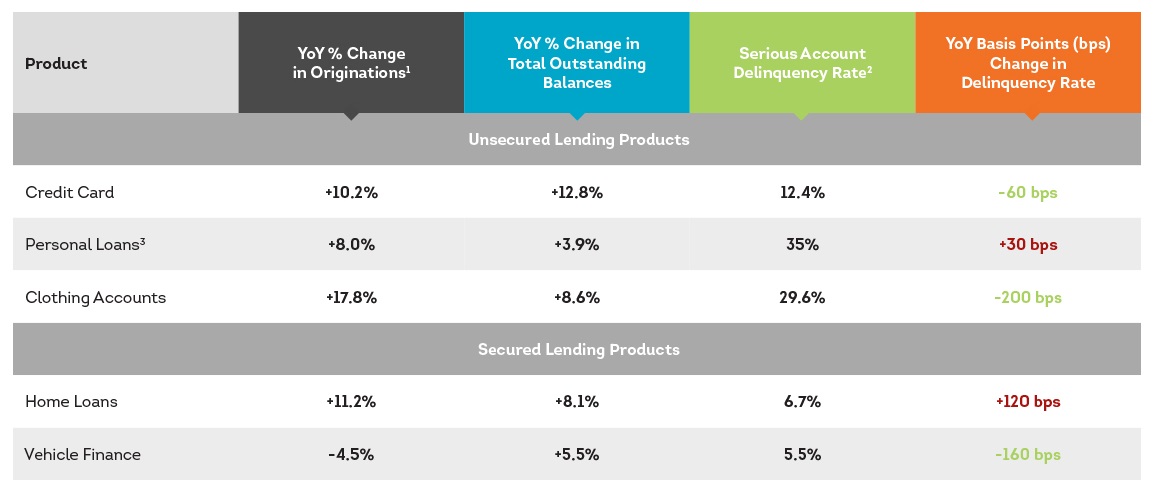

Q2 2023 Metrics for Consumer Credit Products

1 Originations for Q2 2023 compared to Q2 2022

2Account-level serious delinquency rate, measured as a percentage of accounts three or more months in arrears

3Inclusive of both bank issued, and non-bank issued personal loans

“As the cost of living continues to increase, growth in demand and growing balances could signify that many consumers are reliant on credit to help pay for everyday living expenses. Our recent research shows that a substantial majority of repeat and new personal loan borrowers tend to choose lenders with whom they have existing relationships. Lenders should leverage this loyalty dynamic to expand existing relationships and support their customers in a responsible manner, using data insights to tailor loans and products as they navigate a continuously changing economic environment.”

- Weihan Sun, Director, Financial Services Research and Consulting at TransUnion Africa

About the TransUnion IIR Report

TransUnion’s South Africa Industry Insights Report is an in-depth, full population-based solution that provides statistical information every quarter from TransUnion’s national consumer credit database, aggregated across virtually every active credit file on record. Each file contains hundreds of credit variables that illustrate consumer credit usage and performance. By leveraging the Industry Insights Report, institutions across a variety of industries can analyse market dynamics over an entire business cycle, helping to understand consumer behaviour over time.

Businesses can access more details about and subscribe to the Industry Insights Report. The South Africa Industry Insights Report looks at major consumer lending categories: credit cards, personal loans, home loans, vehicle and asset finance (VAF), and clothing. The report primarily focuses on three dimensions across these categories: originations (new accounts opened), balances (outstanding total and average lending balances) and delinquencies (accounts in payment arrears).

Get the Summary

The submission has failed.