SOLUTION

Data Breach Services

Businesses and customers can work together to help reduce the risks of a breach occurring, and remedy harmful ramifications if one does.

In the event of a breach, time is of the essence

Be ready for a potential breach and manage the impacts if an incident occurs

To be POPIA compliant, you must proactively handle risks around data collection, processing and storage. And with evolving cyber threats affecting South African consumers in every demographic, you need an effective response strategy that can mitigate reputational damage, equip customers with tools to combat identity theft, and rebuild trust.

Applications

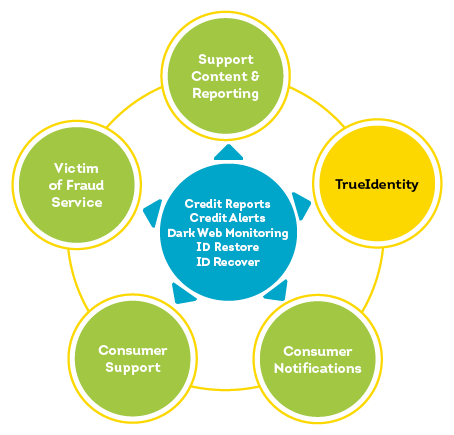

Credit Monitoring

Protect against identity theft by enabling quick action against fraud while offering peace of mind to potentially impacted consumers.

Identity Remediation and Education

Consumers can access credit education, and fraud prevention and identity resolution information, including steps to take if they think they’ve fallen victim.