Q3 2023 Industry Insights

South Africa’s Consumer Credit Landscape Shows Varying Trends in Demand and Supply

Q3 2023 Report highlights include:

- Clothing loans, personal loans, and home loans led growth in new credit activity during Q3 2023, while credit card and vehicle loan originations slowed down

- Consumers continued to build credit balances at a healthy rate, against a backdrop of strong growth in the retail sector

- Portfolio performance in unsecured credit products continued to demonstrate resiliency, while secured products were impacted by higher interest rates and affordability challenges

The latest analysis revealed a mixed picture of demand and supply across lending products. Consumers generally remained resilient during a quarter when economic indicators such as inflation and the South African Reserve Bank’s repo rate were relatively stable.

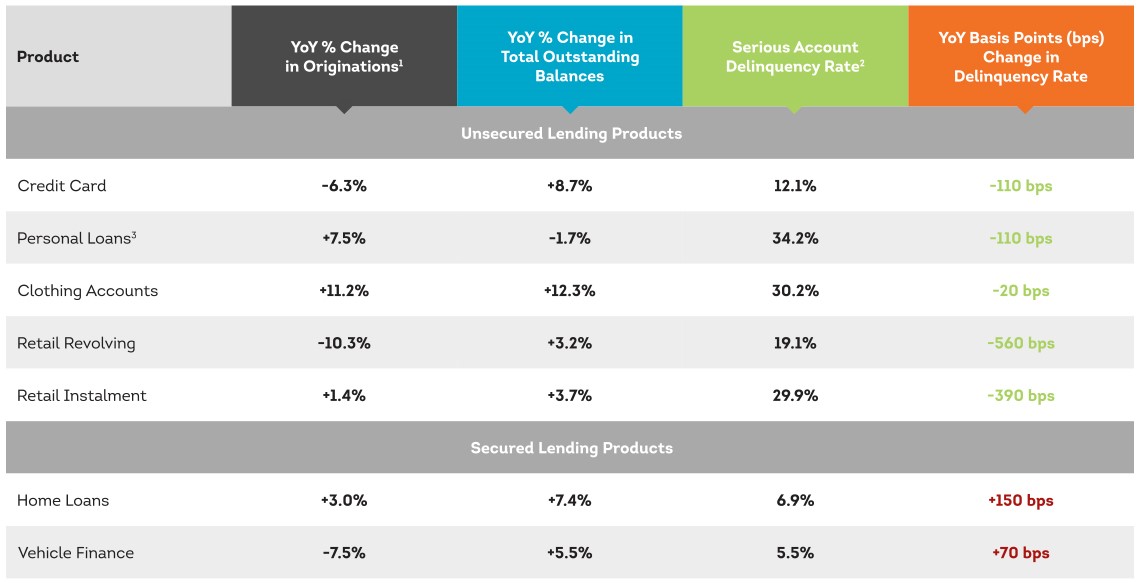

Originations – a measure of new accounts opened – saw the strongest Q3 2023 year-over-year (YoY) growth in personal loans (up 7.5%) and clothing accounts (up 11.2%), while new credit card originations declined (down 6.3%) compared to the same quarter in 2022, as did retail revolving loans (down 10.3%) and vehicle loans (down 7.5%).

Q3 2023 Metrics for Consumer Credit Products

1 Originations for Q3 2023 compared to Q3 2022

2Account-level serious delinquency rate, measured as a percentage of accounts three or more months in arrears

3Inclusive of both bank issued, and non-bank issued personal loans

“Declines in some product originations are likely driven by consumers’ caution in the current high interest rate environment. However, the increase in originations among below prime consumers may be a sign of distressed borrowing to meet financial needs.”

- Lee Naik, CEO of TransUnion Africa

About the TransUnion IIR Report

TransUnion’s South Africa Industry Insights Report is an in-depth, full population-based solution that provides statistical information every quarter from TransUnion’s national consumer credit database, aggregated across virtually every active credit file on record. Each file contains hundreds of credit variables that illustrate consumer credit usage and performance. By leveraging the Industry Insights Report, institutions across a variety of industries can analyse market dynamics over an entire business cycle, helping to understand consumer behaviour over time.

Businesses can access more details about and subscribe to the Industry Insights Report. The South Africa Industry Insights Report looks at major consumer lending categories: credit cards, personal loans, home loans, vehicle and asset finance (VAF), and clothing. The report primarily focuses on three dimensions across these categories: originations (new accounts opened), balances (outstanding total and average lending balances) and delinquencies (accounts in payment arrears).

GET THE SUMMARY

The submission has failed.