Q4 2023 Industry Insights

South Africa’s Consumer Credit Market Remains Resilient, Despite High Interest Rate Environment

Q4 2023 Report highlights include:

- Growth in credit demand and supply continued during Q4 2023, led by Gen Z and Millennials

- Delinquencies improved significantly across most products, apart from home loans

- Healthy growth observed for retail lending products, especially as performance improved

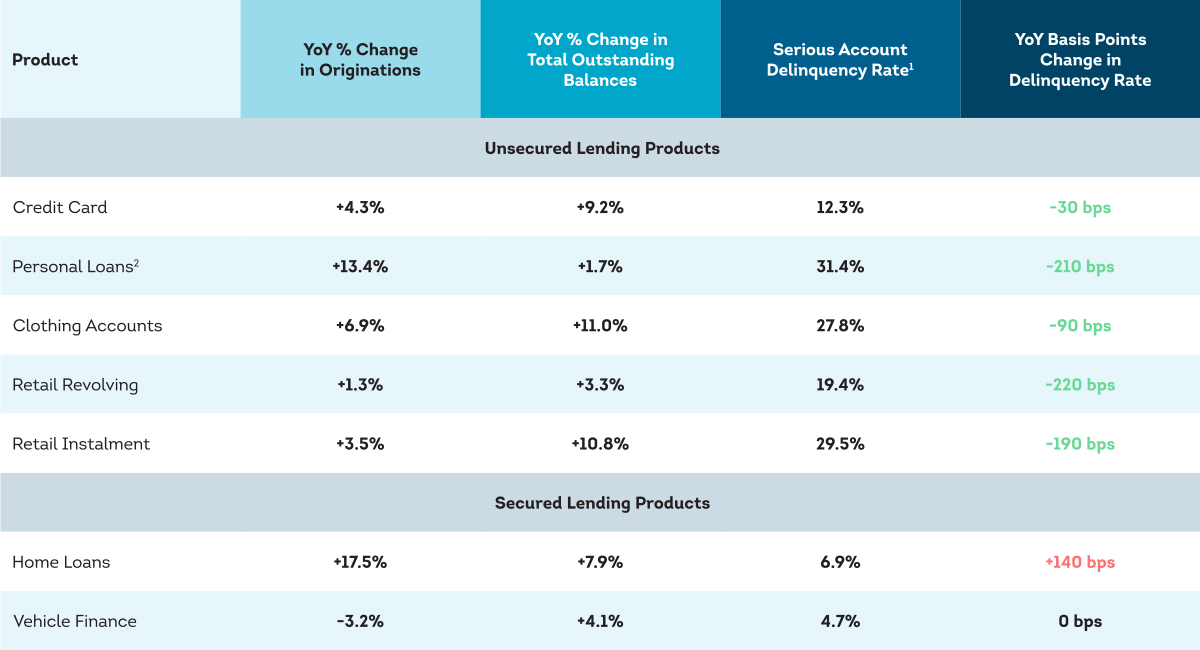

The South African consumer credit landscape maintained its resilience during the last quarter of 2023 with a significant 11% overall growth in originations – a measure of new accounts opened – across all products. The most significant year-over-year (YoY) growth in originations was in non-retail credit products: personal loan (across banking and non-banking sectors) originations increased by 13.4%, home loan originations increased by 17.5% YoY, and credit card originations increased by 4.3% YoY.

Account-level delinquencies across all three retail credit products improved, with retail revolving loans down by 220 bps and retail instalment loans down by 190bps.

Q4 2023 Metrics for Consumer Credit Products

1Account-level serious delinquency rate, measured as a percentage of accounts three or more months in arrears

2Inclusive of both bank issued, and non-bank issued personal loans

“Despite some economic challenges, the South African consumer credit landscape in the last quarter of 2023 showed positive signs of demand for credit and showed resiliency with majority of the consumers managing their credit better. This bodes well for the continued growth of the country’s credit market.”

- Lee Naik, CEO of TransUnion Africa

About the TransUnion IIR Report

TransUnion’s quarterly South Africa Industry Insights Report provides in-depth, statistical information drawn from its national consumer credit database, aggregated across virtually every active credit file on record. Each file contains hundreds of credit variables that illustrate consumer credit usage and performance. Entities across industries can subscribe to and leverage the Industry Insights Report to analyse market dynamics throughout an entire business cycle, helping them understand consumer behaviour over time.

The report looks at major consumer lending categories: credit cards, personal loans, home loans, vehicle and asset finance (VAF), and clothing, focusing primarily on three dimensions across these categories: originations (new accounts opened), balances (outstanding total and average lending balances) and delinquencies (accounts in payment arrears).Businesses can access more details about and subscribe to the Industry Insights Report. The South Africa Industry Insights Report looks at major consumer lending categories: credit cards, personal loans, home loans, vehicle and asset finance (VAF), and clothing. The report primarily focuses on three dimensions across these categories: originations (new accounts opened), balances (outstanding total and average lending balances) and delinquencies (accounts in payment arrears).

GET THE SUMMARY

The submission has failed.