The Q3 2023 TransUnion Vehicle Price Index

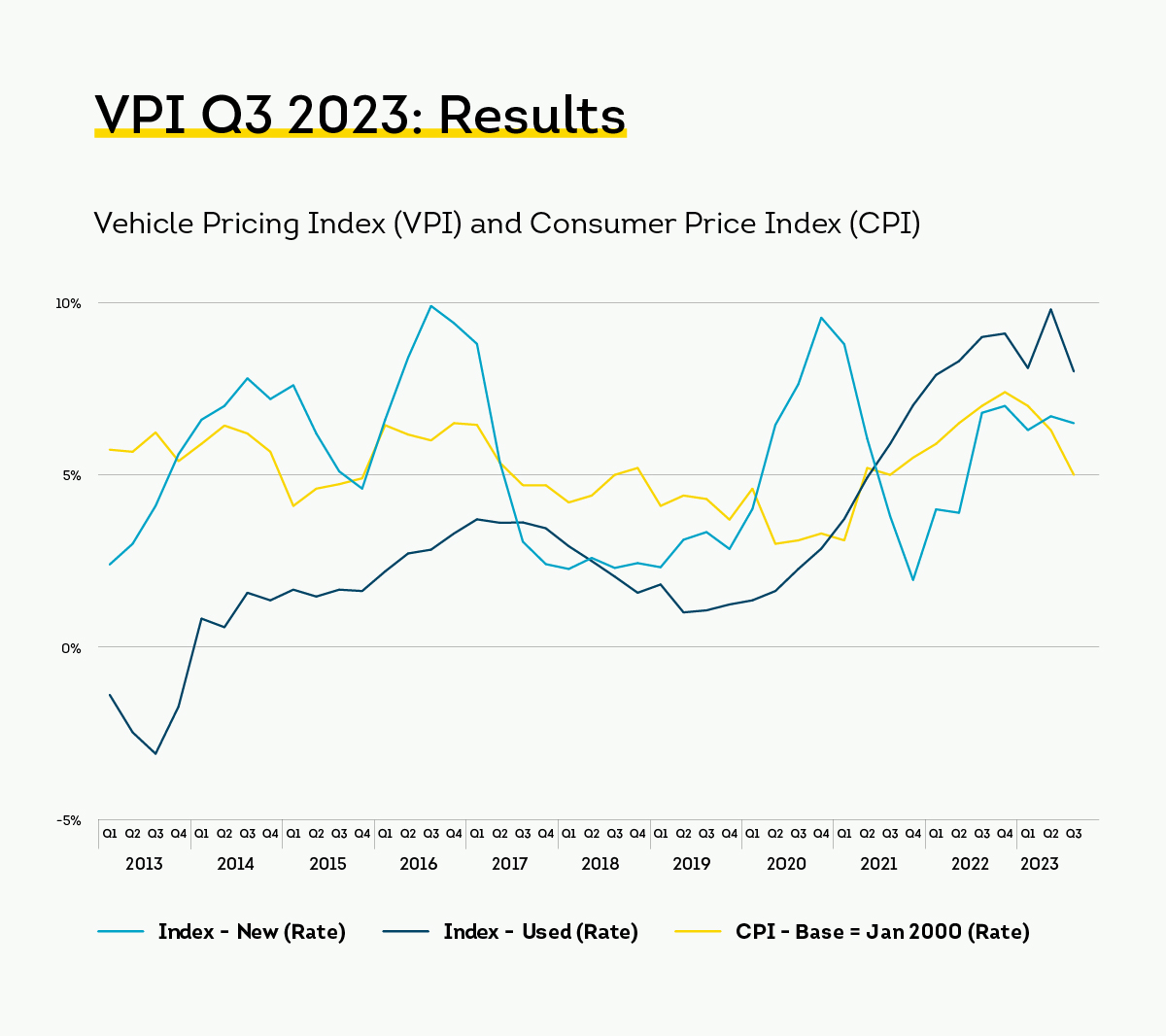

The VPI measures the relationship between the increase in pricing for new and used passenger vehicles, drawing from 15 top-volume manufacturers.

A new perspective on the vehicle market

Our Vehicle Pricing Index (VPI) emphasises financed vehicle trends, integrating vehicle sales with borrowing patterns. While acknowledging the significance of cash purchases, this strategic move delivers crucial insights and provides a detailed analysis of market trends and future directions. This enhanced focus is tailored to help manufacturers, dealers, financiers, OEMs, insurers and consumers more confidently navigate market complexities.

Don't miss out on this essential guide to the South African vehicle market.

VPI Q3 2023 Results

Rising inflation, higher fuel costs and currency fluctuations are squeezing consumer incomes, leading to a decline in vehicle sales. We saw a 8.5% decrease in financed vehicles and 9.1% drop in new passenger vehicle sales as consumers opt for cheaper, older, used vehicles and alternative financing. This trend was reflected in reduced vehicle financing among lower-income individuals. However, manufacturers are countering with discounts and incentives, helping consumers afford vehicles, potentially stabilising and growing the market despite economic headwinds.

VPI Q3 2023 Insights

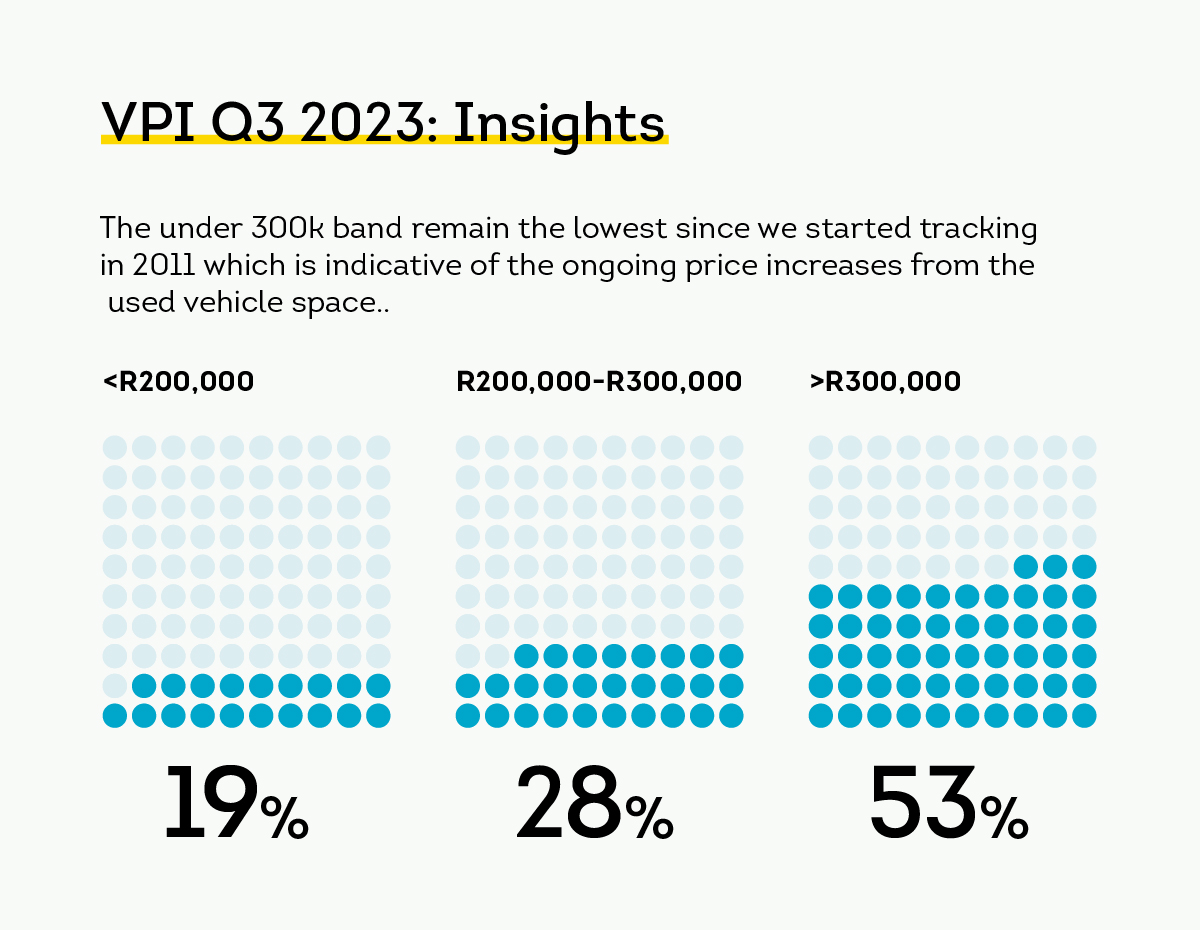

In Q3 2022, the average loan value rose to R359,000 from R317,000, reflecting higher prices and a shift in consumer preferences toward more premium vehicle segments.

20%

30%

50%

<R200,000

R200,000-R300,000

>R300,000

VPI Q3 2023 Assets

Download the report

The submission has failed.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.